Borderless location

Multiply your market access

Spanning Switzerland, France and Germany, the Basel Area offers effortless expansion. With easy setup, low operating costs and one of Europe’s lowest tax burdens, it’s your most valuable discovery.

Multi-market entry, made easy

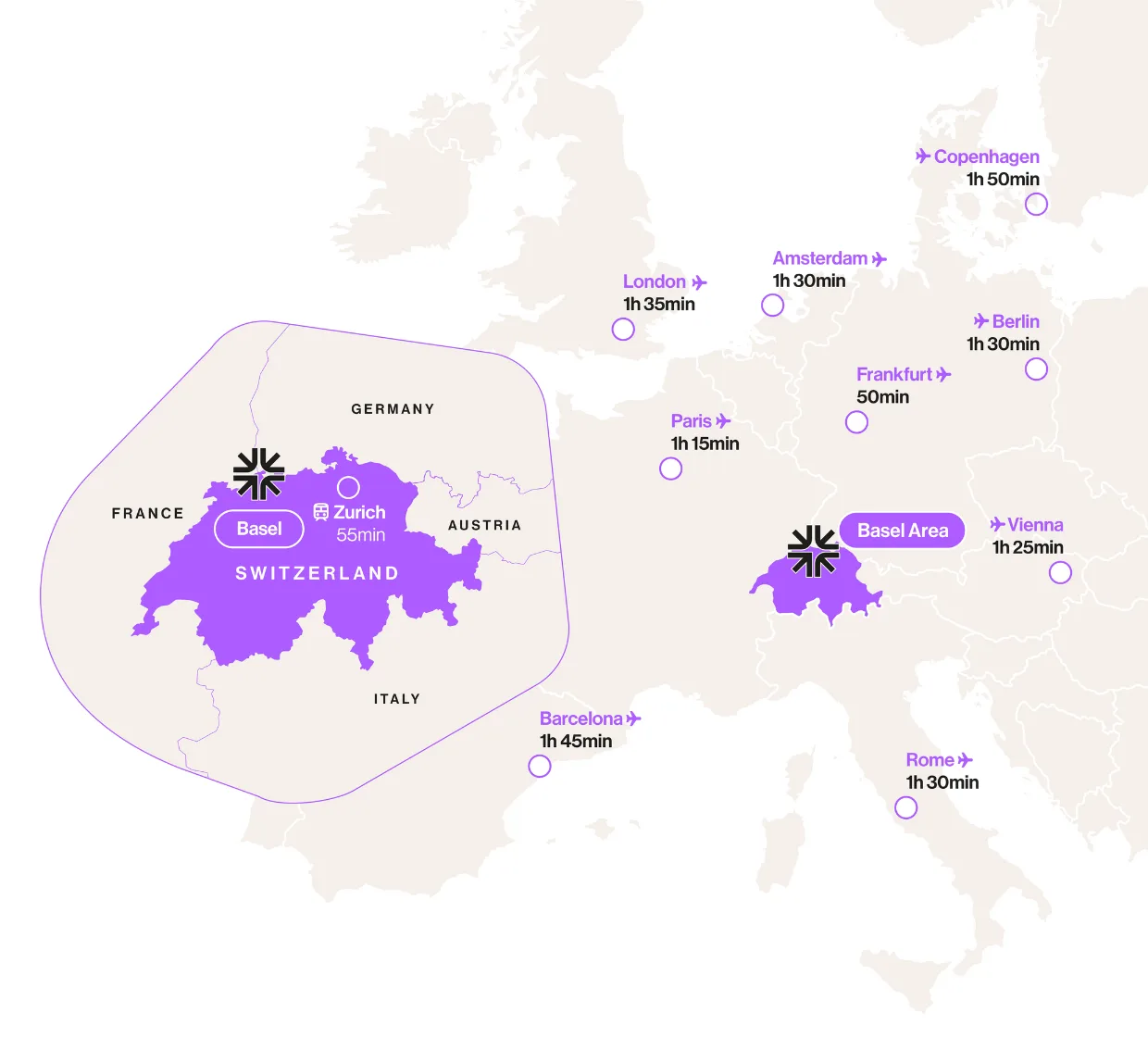

Where Switzerland, Germany and France meet, you’ll find life sciences to the power of three: triple the talent pool, triple the market access, and zero border friction. From here, entering some of the world’s biggest economies is literally a walk in the park, boosting customer reach and multinational clinical trial options in one step. But nothing gets lost in translation, our ecosystem runs in English. And with direct flights from Basel, Europe’s key capitals are all less than two hours away.

< 0 h

to access the best of Europe

~ 0 h

to Zurich Airport

Direct flights to the US

~ 0 min

to Basel EuroAirport

Direct flights to European hubs

Your antidote to complex setup

The Basel Area lets you hit the ground running – and keep sprinting. Liberal labor laws and transparent migration rules unlock global talent fast, while pragmatic authorities treat you as a partner. One‑stop permits and rapid company registration convert setup time into market time. Add Switzerland’s signature safety, stability and predictable regulation plus low taxes, turnkey workspaces and instant access to major markets and your capital starts working from day one.

Tax and incentives

Keep more of every breakthrough

De-risk your research with funding and deductions build for discoveries: access up to 25% cash incentives on R&D costs, alongside one of Europe’s lowest effective corporate tax rates.

A place where risk is rewarded

Access up to 150% in R&D super-deductions. Fewer funding gaps mean capital stays on the bench-top, not the balance sheet, so discoveries move from lab to market faster and safer.

Up to 25% cash incentives for R&D costs

Innovation here starts with immediate cash back: the Innovation Incentive Program rebates R&D salaries, equipment depreciation and Swiss clinical trial spend.

10.7%: one of Europe’s lowest corporate tax rates

Lower taxes, bigger growth: 13% down to 10.7% with R&D and patent box, plus 10-year holidays fueling talent, clinical trials and faster market entry.

Let’s talk

Connect with us to learn more about funding, subsidies and tax incentives available for you in the Basel Area Life Sciences Supercluster.

FAQs

The Basel Area is uniquely positioned at the crossroads of 3 countries, providing seamless access to European and global markets. With two international airports (Basel and Zurich) and flights of under 2 hours available to major EU capitals, it’s ideal for HQs as well as regional coordination.

The Basel Area offers streamlined business registration, transparent labor and immigration laws, and pragmatic authorities. Permits are fast, and companies often start operations within weeks. For more information and free consulting services, get in touch with our team at investinbasel.com

Yes. The Basel Area offers one of Europe’s lowest effective corporate tax rates—10.7% with R&D deductions—and foreign life sciences companies can qualify for tax holidays of up to ten years. In addition, the Innovation Incentive Program provides up to 25% cash back on R&D salaries and equipment costs, while Innosuisse, Switzerland’s innovation agency, funds up to 50% of projects with academic partners. These incentives reduce risk and free up capital for growth and discovery.